A whisky cask can be a great alternative asset, ideal for a long term investment where you are happy to lock the money away for ten or more years. Investors in scotch whisky have made anything from a few thousand dollars, up to the most expensive privately owned cask of whisky ever sold publicly, a cask of Macallan that made more than $1,295,000 (£1,017,000) in 2022.

Of course, it’s important to realize not everyone is fortunate enough to buy the next Macallan! You need to have realistic expectations of cask investment as well as a good understanding of how the market works so that you don’t get caught out in a scam.

If you think that a cask of whisky might be the right investment for you, what else do you need to know before you invest in 2024?

What’s The Difference Between Whiskey and Whisky

Before we get started on our five cask investment tips for 2024, it’s important to clarify that when we talk about investing in whisky casks we are generally speaking about purchasing and holding casks of scotch whisky. Scotch must be distilled and matured in Scotland and is an established global luxury status symbol, which helps give it the long term potential as an asset. There is nothing inherently wrong with buying casks of whisky or whiskey from other countries, but do your research before committing, because they are not the same asset with the same potential.

The Whiskey Wash is now owned by Mark Littler LTD who have been big advocates for more consumer protection within the industry. Littler also partnered with whisky writer and Keeper Of The Quaich Felipe Schrieberg to create protectyourcask.com. We will be sharing more information on cask ownership on The Whiskey Wash in the future, but in the meantime if you are interested in reading and learning more about investing in casks of whisky head to marklitter.com

One: Understand Ownership

Here’s the important part in brief: if you “buy” a cask without a delivery order, you don’t actually own that cask at the warehouse level and can’t be certain the cask exists or is what your seller says it is.

The single biggest way that scammers now and historically have worked is by selling casks that don’t exist, selling the same cask multiple times or by selling a different cask to the one you think you bought. This can all be done when casks are “bought” without a delivery order.

What do we mean by a delivery order? The Scotch Whisky Association describe a delivery order as “a document setting out the details of the cask to be transferred, signed by purchaser and seller and then delivered to the warehouskeeper.”

A delivery order is the industry standard way of buying and selling casks. But for you as a private individual a delivery order does two important things. Firstly, a delivery order transfers the cask into your name at the warehouse level, so you actually own the cask. Secondly, and just as importantly, it acts as a verification from a HMRC certified third party that the cask is what the seller says it is.

The other thing about not getting a delivery order is that it means someone else technically owns that cask at the warehouse. In all likelihood it will remain in the name of whoever you invested with, as an asset on their books, and in their control. But occasionally it can actually be under the name of someone else completely… The point here is that if you are buying this way you need to trust that company implicitly. You also need to be certain they’ll be there in 10 or more years when you come to sell.

If whoever you are buying a cask from says you don’t need a delivery order, or can’t get one without a WOWGR then this is an indication that they either don’t know the industry or are misleading you. Neither are good indicators for a dealer or agent!

Two: Be In It For The Long Term

If I could have picked two points to be my tip number one this would have been joint with delivery orders. Because you might be scammed or lose your money if you don’t get the cask in your name, but you definitely won’t make any money if you approach casks as a short or medium term investment.

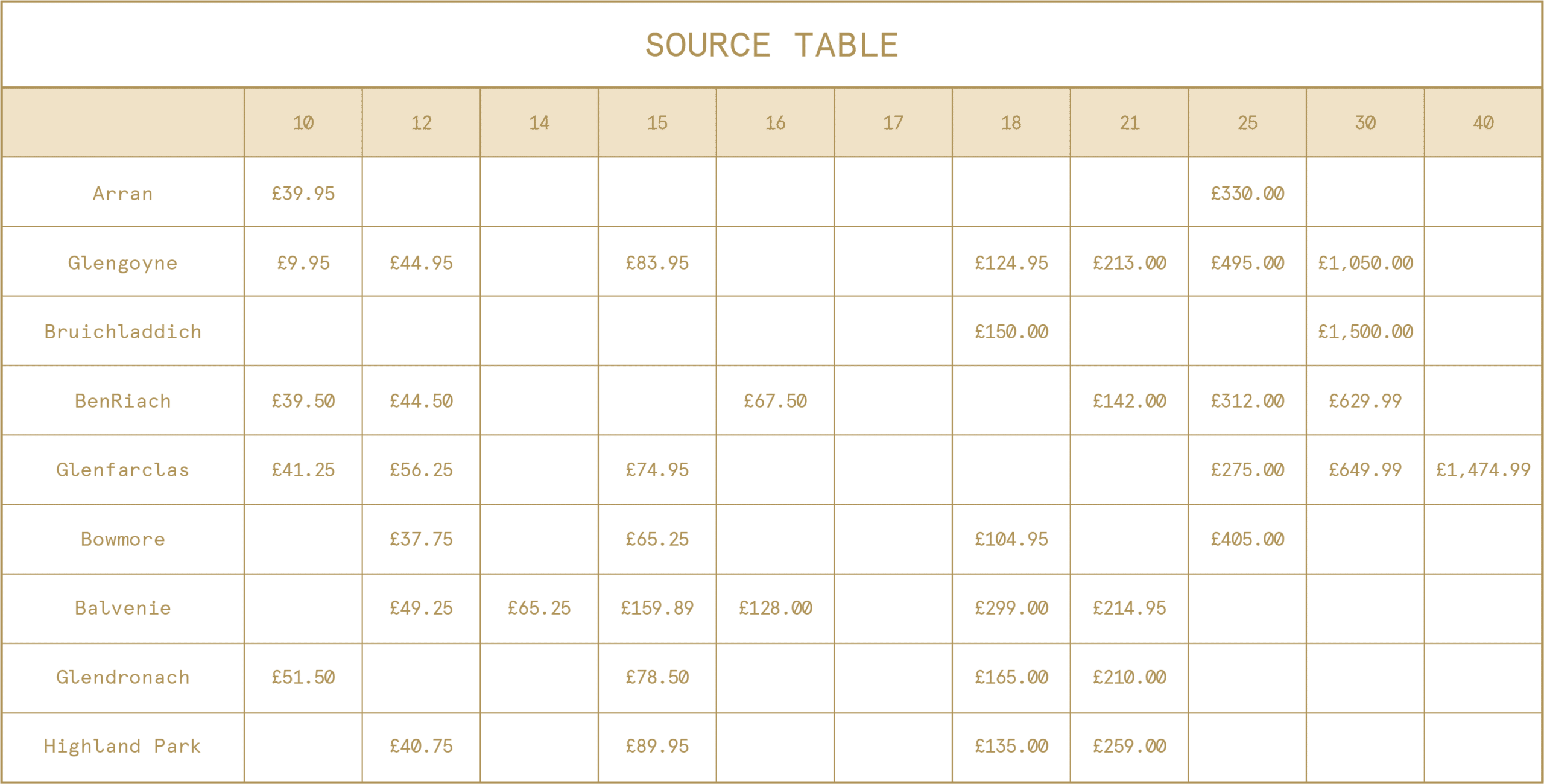

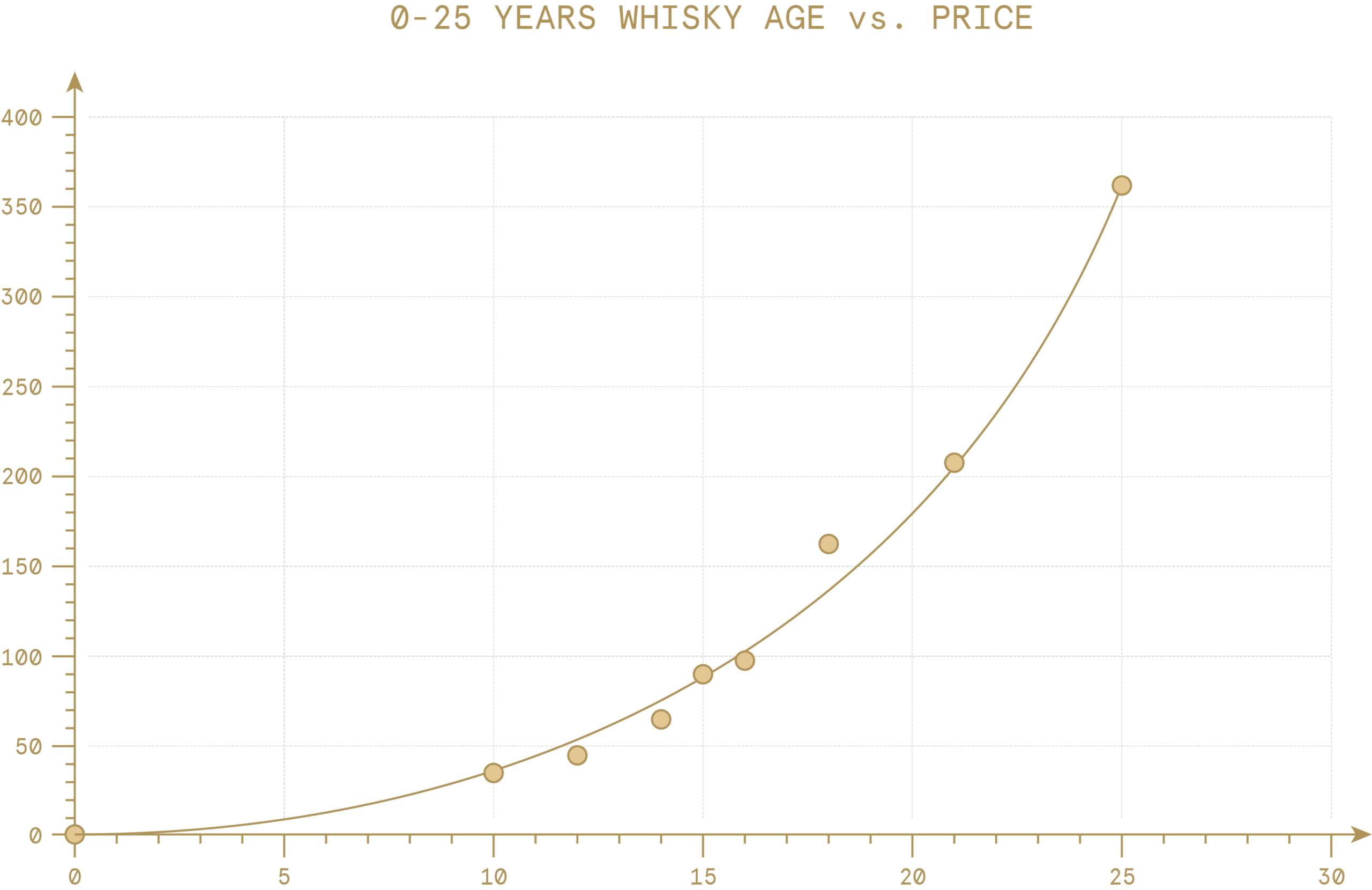

Whisky becomes a premium product around 18 years old. We looked at the average bottle prices of different whiskies to create the below graph to show how the value of whisky changes with age. You shouldn’t divide a cask price by the number of bottles to value a cask (because of taxes involved in getting whisky into a bottle), but as all casks will be bottled eventually, the shape of the curve can act as a good indicator as to the path of the value of scotch whisky in a cask.

The graph shows what you can see when you look at the value of scotch in your local liquor store; whisky becomes classed as a premium product around 18 years old. So if you want to make a profit then you need to at least aim for this age. The source table is at the end of this article.

As most people buy casks as new fill, then this means an 18 year investment to get the best returns. You can buy slightly older “young” whisky aged 3 to 10 years old to get your investment timeframe down but the absolute minimum you should aim for is still around 10 years.

Of course, sometimes circumstances change, and you may need to sell earlier. But generally speaking, if you don’t expect you can tie your money up for at least 10 years—but ideally whatever timeframe you need to get the cask to 18—then we wouldn’t suggest looking at casks as an investment.

Three: Get Naming Rights

Naming rights control how commercial your cask will be when you come to sell it, but what do we mean by “naming rights?”

In Scotland distillery names are usually brand names, which means independent bottlers have to adhere to trademark law when naming their bottles. Casks with naming rights can eventually be bottled with the geographically correct statement “distilled at the XYZ distillery.”

Some casks are sold by the distillery without naming rights, which means they can’t carry the distillery brand name if they are bottled as a single malt. Often these are sold under different non-trademarked names, which people know are associated with a certain distillery, but they still don’t have naming rights and that is what is important for the end value of your cask.

Why? Because the value of whisky as a single malt is tied to the brand of the distillery where it was distilled. While someone with industry knowledge may know that Whitlaw was distilled at Highland Park or Staoisha was distilled at Bunnahabhain, your average consumer will not, which makes that whisky worth less when it eventually ends up bottled on a shelf. As all casks will eventually be bottled a lack of naming rights puts a real constraint on the potential of a cask as an investment.

What’s more, there is no trademark protection for secondary names, which adds more risk for casks without full naming rights. A good example is Bunnahabhain, which used to use the name of the loch behind the distillery for its casks without naming rights, the loch is called Ardnahoe. Fast forward a few years and the Ardnahoe distillery set up and trademarked that name. The Bunnahabhain casks sold with the Ardnahoe name are now only valued as blending whisky, which makes them a completely different proposition to investing in a cask of named single malt whisky.

Four: Stay Away From The Heard

Scarcity is one of the main drivers of value for scotch whisky casks. Brand and quality are important, but as with everything, if there is a lot of it on the market then that will limit your potential when you come to exit.

If you are seeing the same or similar casks sold through lots of brokers then it’s likely that there are a lot of them on the market. This will impact your potential returns when you come to sell your cask, so keep that in mind when searching for the right cask/broker.

Incidentally, these casks are called ‘testicles’ in the trade, as every man in Scotland has two of them.

Five: Keep Up To Date With Market News

As with all investments, educating yourself about the market and keeping up with industry news can help you make decisions. New releases, decisions about investments and new markets opening up for a brand will all have impacts on potential. Staying abreast of this information can help you pick the right time to invest, and to exit.

Make sure you subscribe to The Whisky Wash Newsletter to keep up to date with the latest news and developments. You can also subscribe to the YouTube Channel of Mark Littler, Editor in Chief of The Whiskey Wash, where he regularly posts videos about whisky bottle and cask investments, give it a follow.