Editor’s Note: This guest piece comes to us courtesy of Leon Kuebler from WhiskyInvestDirect.

Single malt Scotch whisky is more popular than ever. Last year, £913m ($1.4bn) worth of single malt whisky was exported from Scotland across the globe. In 2010, single malt exports only generated £576m ($892m) – meaning that, in five years alone, single malt exports have jumped by 58%.

For many years, what single malt lacked in sales volume, it reaped in media attention. This trend has been visible since at least the 1980s, when Michael Jackson began publishing his seminal Malt Whisky Yearbook. Ever since, the growing body of literature on Scotch has tended to focus its gaze on single malt, with blended whisky generally reduced to a supporting role, if mentioned at all.

Given that blended whisky accounts for nine-tenths of all Scotch sold worldwide, the long-running fixation on single malt is slightly misleading. But could single malt finally be in a position to become the most important product of the Scotch whisky industry?

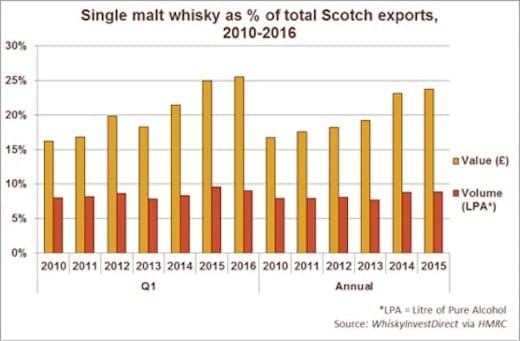

Single malt has increased its market share of worldwide Scotch exports every year since 2010, when HMRC began recording it as a category in its own right. In 2015, 24% of the total value of Scotch exports came from bottles of single malt. For the first three months of 2016, the corresponding figure is higher still, at 26%.

Clearly, when it comes to buying Scotch, more consumers worldwide are spending their money on single malt than ever before. Yet the market share by volume of single malt has broadly remained even over the same period. This means that whisky enthusiasts worldwide are, on average, increasing the amount which they spend on each bottle of single malt every year, rather than simply buying more single malt.

Is the rise of single malt sustainable?

For the market share of single malt whisky to keep rising, one of two things must occur: either the amount of single malt Scotch on the market must rise substantially; or prices of single malts must continue to go up.

The growth in popularity of single malt Scotch has had an impact on the stocks of malt whisky held in Scotland. As Becky Paskin has noted, figures from the Scotch Whisky Association showed an average drop of 6% per annum in stocks of malt whisky aged 11 years and older.

Given that production of malt whisky increased over the same period, the decade-long ‘drought’ of Scotch malt whisky is unlikely to arrive any time soon. However, the drop in aged stocks of malts does suggest that the industry may continue to have difficulty releasing older stock in the near future.

One visible outcome of this development has been the rise of No Age Statement (NAS) whiskies – products where the age of the Scotch inside is not disclosed. NAS whiskies have become a source of some controversy among Scotch lovers. Just six years ago, 89% of drinkers polled in nine countries by Chivas Regal stated that they actively sought out an age statement on their Scotch. Despite this feedback, many companies – including Chivas Regal themselves – have since proceeded to removed age statements from some of their whiskies.

It remains to be seen whether whisky enthusiasts will remain willing to pay the same price (or more) without knowing the age of their Scotch. What is clear, however, is that for single malt whisky to become more valuable than blends to the Scotch industry as a whole, as some have argued will happen, consumers worldwide will have to substantially increase the amount they spend on each bottle of single malt, at the same time as the amount of older Scotch malt whisky is declining. This, it is fair to say, may prove difficult.

Scotch is a luxury product, and single malt has traditionally proven more expensive than blended whisky. It would therefore appear that single malt has benefitted from the move to more ‘premium’ spirits that other aged spirits, like Cognac and Armagnac, have also experienced.

In fact, blended Scotch has also responded to growing desires for higher-quality, ‘premium’ whisky. The difference between the largest market for Scotch by value, the United States, and by volume, France, comes from attitudes towards blends, not single malts. In 2016 Q1, the average American consumer spent two-and-a-half times as much on blended Scotch as their French compatriot. The same is also true in Singapore, the third most valuable market for Scotch, where even more was spent on blended whisky per LPA exported than in the United States. In each country, single malt still only accounted for 25%-30% of all Scotch exported in 2015.

Outside of established markets for Scotch, the prospect for blends appears even better. As a new report by Just Drinks suggests, blends are likely to continue to perform strongly in emerging markets in particular, with the organisation predicting that blended whisky is poised for a global renaissance. In countries driving growth in Scotch whisky exports, such as Mexico – where nearly as much money was spent on Scotch as on Tequila in 2014 – single malt sales are less than one-tenth of all Scotch sales by value.

In short, single malt has enjoyed a huge rise in popularity in recent years, which is likely to continue. Despite this, there are significant structural obstacles to malt whisky overtaking its blended counterpart – to say nothing of the fact that, in most countries, blended whiskies continue to be highly popular in their own right.

For these reasons alone, the presumed irrelevance – or even imminent demise! – of blended Scotch whisky should be reconsidered. Blended Scotch whiskies have been cast as single malt’s poor relations for too long. They deserve, once again, to be taken seriously.