In late March, established and emerging craft distillers from around the nation converged on Portland for the annual American Distilling Institute conference, marketed as the oldest and largest gathering of distillers in the United States. Each year, the ADI conference is held in a different city, and this year it just so happened to show up at The Whiskey Wash’s back door. Lucky us!

The mood this year was a complex cocktail of jubilant (the recent FET reduction), determined (the accelerating pace of acquisitions means there are now fortunes to be made), and wary (competition is heating up, and the stakes are higher every day). This year, I met fewer starry-eyed entrepreneurs and more existing businesses (even those from overseas, like Japan and Europe) interested in topics like positioning a company for acquisition, financing major equipment purchases, and expanding distribution outside their home states. I met lots of distillers excited to start selling their long-awaited mature whiskey, as well as still more producers eagerly chatting with bulk alcohol distributors like Teressentia and MGP in the hopes of getting a leg up on cash flow.

In other words, it felt like an industrial coming-of-age, with all the excitement and jitters that come along with leveling up to the big leagues.

Michael Kinstlick, chief executive officer of Coppersea Distilling and ADI research economist, once again presented the latest findings from the ADI craft distillery survey, and once again, the figures were astonishing. (For your own full copy of Michael’s white paper, visit Coppersea’s website here.) As of the end of 2017, there were 2,598 active DSPs in the United State. That figure includes approximately 1,400 craft distillers actually producing spirit for sale domestically, a couple hundred blenders and infusers, and about 1,000 recently issued DSPs that haven’t begun producing product yet. Right now, the TTB issues an average of two new DSPs every single working day.

Many are eyeing the current softening in the craft beer market warily, beginning to wonder if craft distilling is headed for a similar rough patch. Hearteningly, Michael doesn’t seem to think so. “I see no new signs of a slowdown in new DSP adds, and no signs of an uptick in new DSP drops,” he said during his address. “It’s hard for me to draw the conclusion yet that we are at peak craft, or the craft boom is slowing down in a meaningful way.”

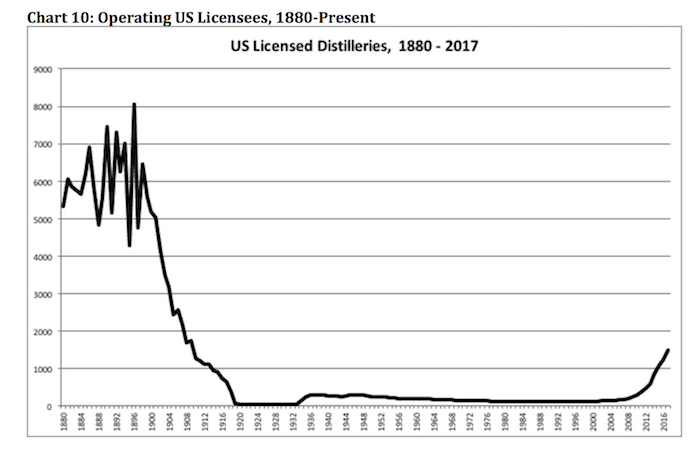

Perhaps the most compelling illustration of the space the U.S. craft industry has to grow is the following graph, which charts the number of licensed distilleries in the United States form 1880 to the present. In the 1890s, when our population was a fraction of its current size, there were more than 8,000 American distilleries. In comparison, today’s 1,400 sounds like a proverbial drop in the barrel.

Beyond the economics, craft spirits—especially craft whiskey—have come a long way over the past five years. Products are superior—they’re more mature, they taste better, and their stories and packaging are as polished and sophisticated as the big guys’. Wood Hat Spirits in New Florence, Missouri, won Best Whiskey in Category for its Bloody Butcher Red Corn Whiskey, while Fleurieu Distillery from Goolwa, Australia, nabbed the top spot in the International Whiskey category.

Yet recent growth in the spirits market hasn’t only lifted craft ships. Over the past five years, Michael showed how the largest distillers have grown their volume by a much larger margin than craft producers. That might sound like bad news, but it also means the craft industry, which currently comprises just 1.75% of the entire spirits market, has plenty of room to grow. With the way craft whiskeys are tasting these days, that’s good news for everybody who likes a great drink.